Direct Investment in African Gold Mines:

Structuring Deals for Maximum Returns

While the global gold price grabs headlines, the real value often lies where institutional banks cannot reach. For medium-sized investors (USD 1–10 million), African "junior" miners offer a unique "Orphan Capital" opportunity by combining high operational leverage with significant upside. This guide explores the specific deal structures - from Convertible Notes to Royalties - and the due diligence required to turn geological potential into profitable reality.

A. Strategic Entry: Structuring Investments for "Orphan Capital"

For a direct investor in the USD 1 to 10 million range targeting smaller or "junior" mining operations in Africa, the investment structure is rarely as simple as buying shares on a stock exchange.

This capital range is often referred to as the "Orphan Capital" stage in mining. It is typically too large for friends and family rounds, yet too small to attract major institutional funds or international banks. Consequently, deal structures in this niche are highly negotiated and bespoke.

Below are the most effective structures for these investments, ranked by prevalence and suitability for this specific tier of investing.

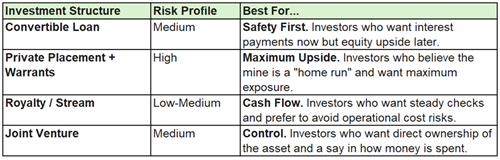

1. Convertible Loan Notes (CLNs)

Best for: USD 1 – 5 million range | Private or Micro-cap Public Miners

This is arguably the most common structure for entering the African junior mining space.

- How it works: You lend capital to the mining company (e.g., $2 million) with a fixed interest rate (often high, e.g., 8 - 12% or higher). The key feature is the "conversion option": at maturity or upon hitting specific milestones, you have the right to convert that debt into equity (shares) at a pre-agreed price, or demand repayment in cash.

- Why it fits this profile:

- Downside Protection: If the mine fails to hit its targets, you remain a creditor, ranking higher than shareholders in a liquidation event.

- Upside Potential: If the mine hits a "bonanza" grade or the gold price spikes, you convert to equity to capture the capital gains.

- Speed: It is faster to execute than a full equity round because it avoids immediate valuation disputes (allowing both parties to "kick the can" on valuation until conversion).

2. Private Placement (Direct Equity) + Warrants

Best for: USD 5 – 10 million range | Growth Capital

For slightly larger investments, investors often take a direct equity stake via a Private Placement.

- How it works: You purchase a block of shares directly from the company treasury, usually at a discount to the current market price (if listed) or at a negotiated valuation (if private).

- The "Sweetener" (Warrants): Crucially, these deals almost always include "Warrants." For example, for every share you buy, you receive a "half-warrant" or "full-warrant" that allows you to purchase another share in the future at a fixed price.

- Why it fits this profile: Warrants provide "super-leverage." If the mine succeeds and the share price triples, your warrants become incredibly valuable, effectively increasing your ownership percentage for free.

3. Net Smelter Return (NSR) Royalty or Streaming

Best for: Investors seeking revenue without operational exposure

This is a highly specialized form of financing attractive to investors who prioritize cash flow over control.

- How it works (Royalty): In exchange for upfront capital (e.g., $5 million), the mine agrees to pay you a fixed percentage (e.g., 1% to 3%) of the revenue from every ounce of gold sold, for the life of the mine.

- How it works (Stream): You pay upfront for the right to purchase a percentage of future gold production at a deeply discounted price (e.g., purchasing at $400/oz when the market price is $2,000/oz).

- Why it fits this profile:

- Revenue Focus: You are paid off the "top line" (revenue), not the "bottom line" (profit). You are insulated from excessive office expenses or executive salaries; as long as gold is produced, you get paid.

- Inflation Hedge: If the gold price rises to $10,000, your 1% royalty rises in value proportionately, with no additional cost to you.

4. Earn-In / Joint Venture (JV)

Best for: Investors with technical expertise

- How it works: Instead of providing cash for shares, the investor funds a specific activity (e.g., "Investor pays for the next 5,000 meters of drilling"). As the funds are deployed, the investor "earns in" to a percentage ownership of the project itself (Project Level Interest), rather than the parent company.

- Why it fits this profile: It isolates risk. You own a piece of the specific mine asset, protecting you from debts or lawsuits that may affect the parent company.

Summary: Selecting the Right Structure

The Hybrid Approach:

For a USD 1–10M investor in Africa, the most sophisticated approach is often a hybrid.

Example: A $5M investment composed of a $3M Convertible Loan (for downside safety) + a $2M Gold Stream (for immediate cash flow).

B. The Mandate for Due Diligence: How to Engage

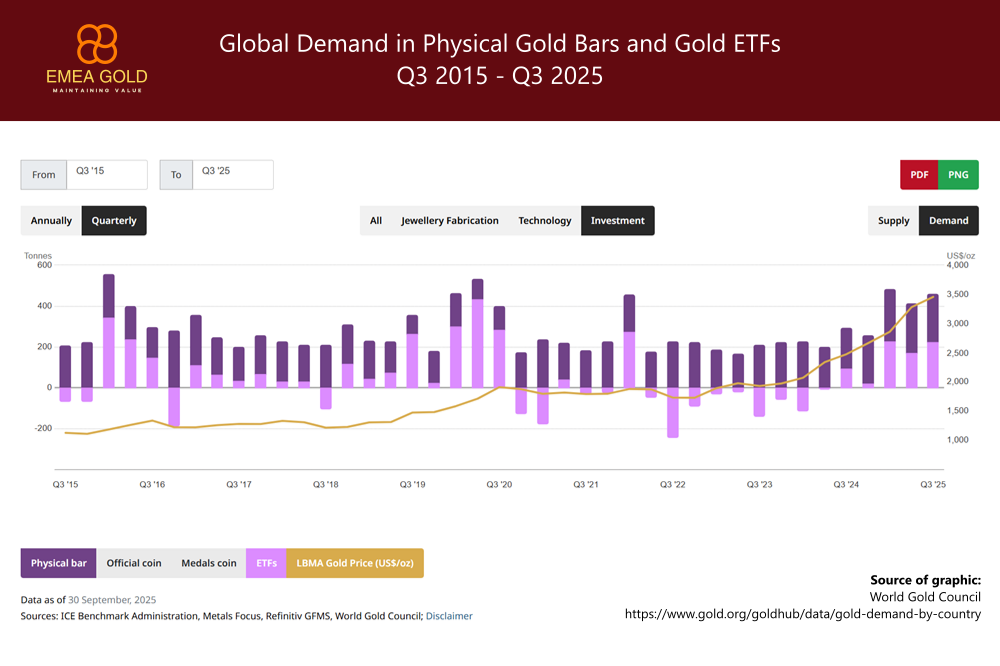

Direct investment in gold mines offers superior rewards because it requires active engagement. Unlike clicking "buy" on an ETF, you are investing in an industrial business. Prospective investors must step out from behind the desk and apply a rigorous verification process tailored to the project's stage.

1. General Requirements (For All Projects)

- Mandatory Site Visits: Never invest based solely on a glossy prospectus or a PowerPoint deck. A physical visit to the mine site is non-negotiable. Investors need to verify the reality on the ground, assess the condition of local infrastructure (roads, power access), and gauge the morale and competence of the on-site workforce.

- Independent Technical Verification: Do not rely on internal company estimates. Demand technical reports compliant with international standards, such as Canada's NI 43-101 or Australia's JORC Code. These are sound standards that require independent "Qualified Persons" to sign off on resource estimates, providing a crucial filter against exaggeration.

- Social License to Operate: In both Africa and elsewhere, a mine cannot function without the support of the local community. Investigate the mine’s relationship with local stakeholders. Are they employing locals? Are there land disputes? A hostile local population is a paramount operational risk that does not show up on a spreadsheet.

2. Specifics for Operating Mines

- Reviewing Financial Health: Focus intensely on All-In Sustaining Costs (AISC), not just "cash costs." AISC includes sustaining capital expenditures, corporate G&A, and exploration needed to replace depleted reserves. It is the only true measure of a mine's long-term viability.

- Machinery & Equipment Audit: Verify that the machinery described actually exists and is operational. Check maintenance logs to ensure production won't be halted by foreseeable equipment failure.

3. Specifics for Greenfield Projects (Mines Yet to be Set Up)

Investing in a mine before construction begins ("Greenfield") offers the highest potential returns but carries specific development risks. Due diligence here must focus on feasibility and permitting:

- License Validation: Verify the status of the Mining License (Exploitation Permit). Many companies hold only an Exploration License, which allows them to drill but not to build a mine or sell gold. Ensure the transition to a full mining license is legally secured or imminent.

- Resource Classification: Scrutinize the drilling data. A "resource" is not a "reserve." Ensure a significant portion of the gold is classified as "Indicated" or "Measured" (high confidence) rather than just "Inferred" (speculative). Banking on "Inferred" resources for a mine plan is a common cause of failure.

- Infrastructure & CAPEX Reality Check: A gold deposit is worthless if you cannot power the mill. Rigorously audit the Capital Expenditure (CAPEX) budget. Does the site have access to water and electricity, or must the investor fund a 50km power line? Underestimating infrastructure costs is the number one reason new mines run out of cash.

- The "Builder" Track Record: An excellent geologist is rarely an excellent construction manager. Assess if the management team has a track record of actually building and commissioning mines, not just finding deposits. The skill set required to pour concrete and install ball mills is vastly different from drilling holes.

The EMEA GOLD Eco System for Investors in African Gold Mines

EMEA GOLD bridges the gap between sophisticated mid-sized investors and high-potential African mining projects. We provide a secure, end-to-end ecosystem that de-risks direct investment by curating pre-vetted opportunities and structuring them through regulated EU vehicles in Cyprus. Our role extends far beyond introduction: acting as your steward on the ground, we manage technical due diligence, control capital releases based on milestones, and secure final gold offtake. By combining rigorous local monitoring with European legal protection, EMEA GOLD transforms complex mining ventures into a transparent, managed asset class, ensuring your capital is safeguarded while targeting maximum returns.

EMEA GOLD - your trusted partner for direct investment in gold mines.