Is Gold a Good Investment?

Price Influencers and an Attempt at a Gold Price Forecast

Gold has served as a store of value for thousands of years and remains one of the few assets that is not simultaneously someone else’s liability. For investors seeking long-term security, capital preservation, and protection from systemic risk, physical gold ownership continues to play a central role in prudent wealth management.

In the short term, physical gold can act as an effective hedge against market volatility, financial shocks, and geopolitical uncertainty. During periods of crisis or market dislocation, tangible gold held outside the banking system often retains its value when confidence in financial assets weakens. This makes physical gold particularly attractive to investors who prioritise security and asset protection over short-term price movements.

In the medium term, gold prices are influenced by macroeconomic factors such as inflation, interest rates, central bank policy, and currency stability. While price fluctuations are inevitable, holding physical gold—especially when securely stored in professional vaults—allows investors to remain insulated from counterparty risk and short-term market noise. As part of a diversified portfolio, physical gold can provide balance and resilience during changing economic cycles.

In the long term, gold’s fundamental strength lies in its scarcity, durability, and universal acceptance. Unlike fiat currencies, gold cannot be printed or devalued through monetary policy. Its purchasing power has been preserved over centuries, across multiple monetary regimes. For this reason, physical gold continues to be regarded as a reliable store of wealth, particularly for investors with a multi-generational perspective.

Looking beyond 2027, the long-term outlook for gold remains constructive. Global population growth, increasing wealth in emerging markets, and ongoing geopolitical tensions are likely to sustain demand. At the same time, the supply of newly mined gold is structurally constrained, as new discoveries become rarer and mining projects more complex and capital-intensive. These factors support a positive long-term environment for gold prices and reinforce the case for holding physical bullion as a strategic asset.

What Influences Gold Prices?

Although gold’s intrinsic value is stable over time, its market price fluctuates in response to a range of economic and geopolitical factors.

Inflation

Gold has historically been viewed as a hedge against inflation. When inflation rises, the purchasing power of fiat currencies erodes, prompting investors to seek tangible assets that preserve real value. Physical gold, in particular, offers protection against long-term currency debasement, as it exists independently of any monetary system.

Currency Movements

Gold prices are closely linked to currency trends, especially the US dollar. A weakening currency typically supports higher gold prices and increases international demand. For investors holding physical gold, this dynamic reinforces gold’s role as a hedge against currency risk and monetary instability.

Geopolitical Risk

Periods of geopolitical tension, political unrest, or armed conflict consistently drive demand for physical gold. In such environments, investors often seek assets that are portable, universally recognised, and independent of financial intermediaries. Physical gold stored in secure, private vaults offers a high degree of protection during times of global uncertainty.

Interest Rates

Interest rates influence gold prices by affecting the opportunity cost of holding non-yielding assets. While rising rates may create short-term price pressure, they do not diminish gold’s long-term function as a wealth preservation asset. Investors focused on physical gold typically prioritise security and real value over nominal yields.

Supply Constraints

Gold supply is naturally limited. Declining ore grades, increasing production costs, environmental regulations, and geopolitical risks in mining regions all contribute to constrained supply growth. This scarcity underpins gold’s long-term value and differentiates it from financial assets that can be created in unlimited quantities.

Gold Price Outlook: The Next 10 Years

The medium- to long-term outlook for gold prices remains positive. Leading financial institutions such as UBS and Goldman Sachs have recently raised their gold price forecasts, citing persistent macroeconomic uncertainty, strong demand, and ongoing geopolitical risks.

While price forecasts should always be treated with caution, these projections reflect growing recognition of gold’s role as a strategic reserve asset. For investors holding physical gold, short-term price fluctuations are generally less relevant than the broader trend of long-term value preservation.

Gold Price Outlook: The Next 20 Years

Forecasting gold prices two decades into the future is inherently uncertain. Over such long time horizons, economic cycles, monetary systems, and geopolitical landscapes can change significantly.

What remains consistent, however, is gold’s function as a neutral, apolitical asset. Central bank reserve policies, global debt levels, inflation trends, and currency stability will all influence gold demand. Historically, periods of financial stress and monetary experimentation have reinforced the importance of holding physical gold outside the financial system.

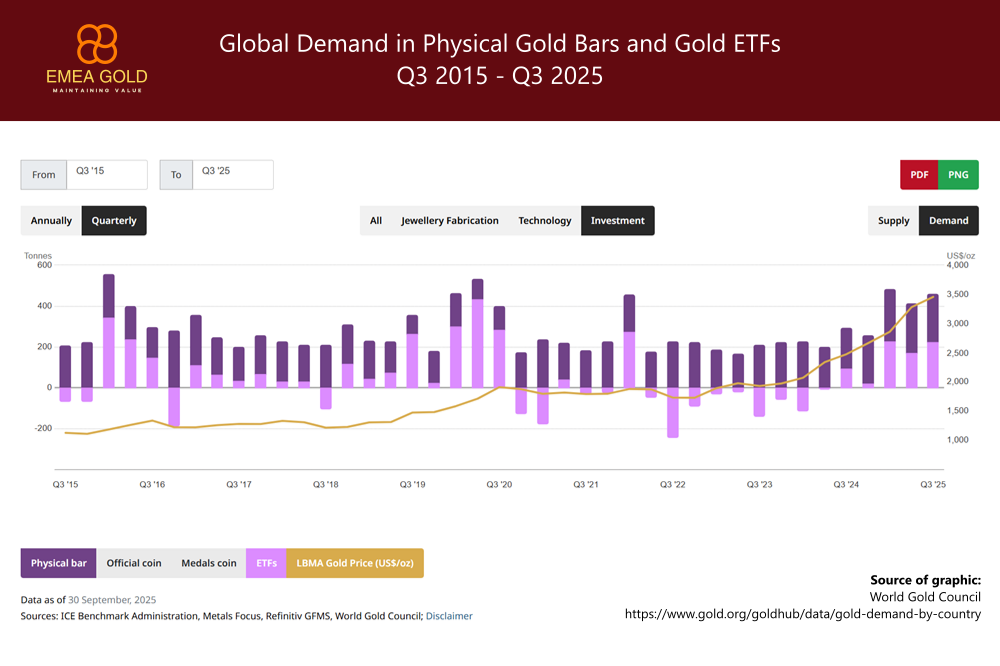

Long-term gold prices will continue to be shaped by supply and demand fundamentals, including jewellery consumption, investment demand, industrial use, and mining output. While precise forecasts are unreliable, the strategic case for physical gold ownership remains compelling.

Gold Technical Perspective

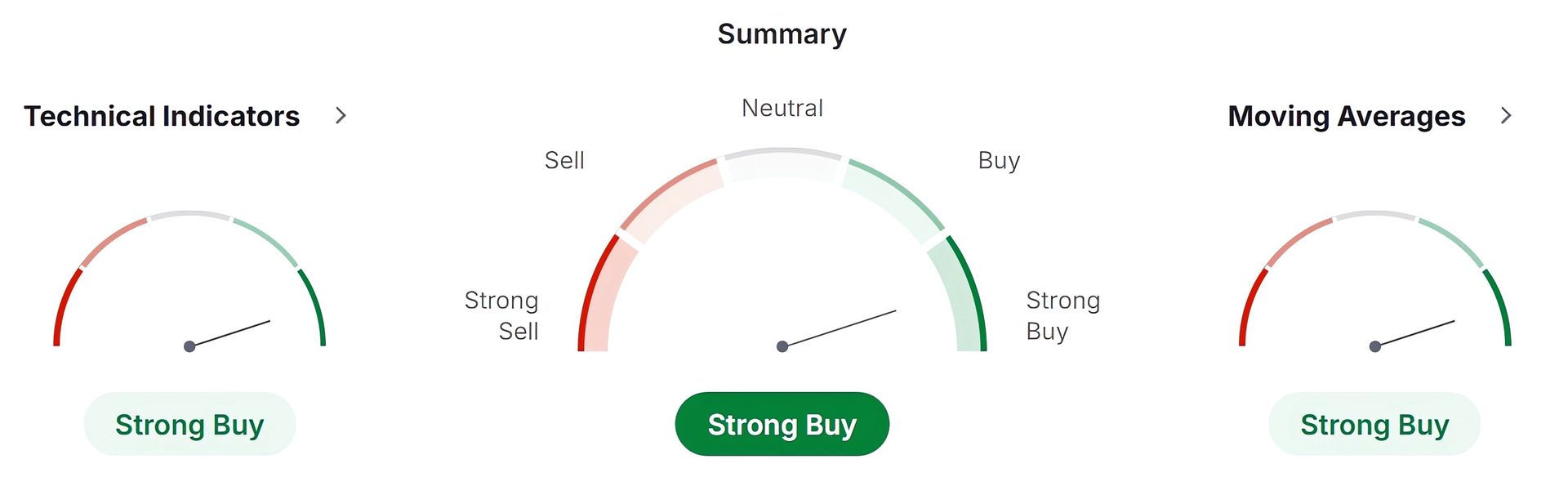

As of October 2025, gold prices have traded near historic highs, reflecting strong investor demand amid heightened geopolitical and economic uncertainty. The price increase observed in 2025 has been driven by rising inflation concerns, geopolitical tensions, and a renewed focus on tangible assets.

Technical indicators suggest that gold remains in a strong long-term uptrend. While short-term corrections are always possible, these movements are typically of limited relevance to investors focused on physical gold ownership and secure storage rather than active trading.

Physical gold held in professional, high-security vaults offers investors direct ownership, independence from financial intermediaries, and long-term protection of purchasing power. For those seeking stability, diversification, and resilience in an increasingly uncertain world, physical gold remains a cornerstone asset.

Whether your priority is stability, diversification, or yield generation anchored in the gold sector, our services are built to support a disciplined, high-integrity investment strategy.

This article is based on information provided by https://j2t.com, including the two images within the text.