Direct Investment in Gold Mines

The best and most profitable medium to long-term investment in gold

January 14, 2026

Why does direct investment in gold mines increasingly attract investors?

Since mid-August 2025, the global financial ecosystem has witnessed a profound shift. The price of gold has not merely risen; it has reasserted itself as the premier global store of value amidst a backdrop of persistent inflation stickiness in developed economies, accelerated de-dollarization efforts by the expanded BRICS+ bloc, and simmering geopolitical flashpoints. This sustained bullish trend has reignited broad investor interest in precious metals. However, among sophisticated capital allocators, it has triggered a specific, sharp increase in demand for direct investment in gold mines, specifically in small and medium-sized gold mines.

As we navigate the opening weeks of 2026, with gold commanding headline prices, it is imperative to look beyond the spot price and analyse the mechanics of the market. This article argues that for the medium-to-long-term investor, direct participation in gold production is superior to traditional investment vehicles. We will examine the structural house of cards that is the "paper gold" market, the unique operational leverage of mining economics, and why the African continent has become the primary target for Western direct investment capital.

A. The Divided Landscape of Gold Investing

To understand the unique value proposition of direct mining investment, we must first categorize the broader market participants. Historically, most gold investors fall into two distinct camps based on their time horizon and risk tolerance.

1. The Short-Term Speculator (Paper Markets)

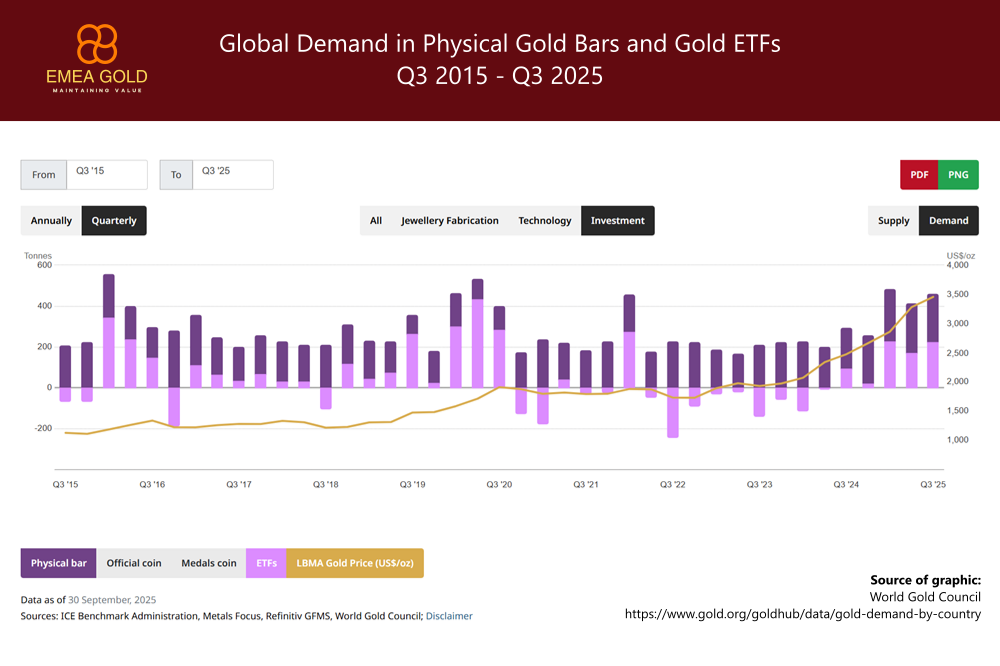

This group focuses on capturing rapid gains through financial instruments. They utilize ETFs (Exchange Traded Funds), gold funds, futures contracts, and options (both long and short). Their exposure is primarily to price volatility rather than the asset itself. For these investors, gold is merely a ticker symbol on a screen, a vehicle for arbitrage or momentum trading.

2. The Medium-to-Long-Term Preservationist (Physical Markets)

This group seeks to insulate wealth from systemic threats. They are motivated by fears of currency debasement, central bank policy failures, national debt crises, and banking sector instability. Their solution is purchasing physical bullion - bars and coins - taking possession to decouple their wealth from the counterparty risks inherent in the banking system.

While the preservationist correctly identifies physical gold as the ultimate hedge, both groups face a common, often gross underestimated threat: the massive distortion created by the financialization of the gold market.

B. The "Paper Tiger": Exposing Structural Flaws in Gold Pricing

The fundamental flaw facing nearly all gold investors today is a harsh reality: the global spot price - the number flashing on trading terminals worldwide - is rarely determined by the supply and demand of physical metal. Instead, it is overwhelmingly driven by the supply and demand of "paper gold."

Paper gold refers to derivatives, futures contracts, and "unallocated" accounts that represent a claim on gold rather than ownership of specific bars. The forms of investment favoured by speculators - ETFs, futures, and options - always represent a credit claim and are therefore exposed to counterparty risk.

Crucially, the vast majority of gold ETFs and funds are only partially backed by physical gold allocated specifically to shareholders. Even more precarious are futures and options contracts, which are technically not backed by physical gold at all, but rather by the balance sheet of the issuing exchange or bullion bank.

The Leverage Problem

The scale of the imbalance between paper claims and real metal is staggering and constitutes a systemic risk. Financial analysts estimate that the global volume of paper gold investments currently fluctuates between USD 200 to 300 trillion. In stark contrast, the total value of the global market for accessible physical gold is estimated at only approximately USD 11 trillion.

This creates a precarious leverage ratio. On a global average, for every ounce of physical gold that exists above ground, there are roughly 20 to 30 ounces of paper claims circulating in the financial system. However, many industry experts and insiders, analysing data from major hubs like the London Bullion Market Association (LBMA) and the COMEX in New York, suggest the real ratio of claims to available physical ounces is closer to 100:1.

The implications of this ratio are profound. It means that if even a small fraction of paper holders demanded physical delivery simultaneously, the market would fail.

Compounding this issue is the shrinkage of available float. Approximately 20% of all global physical gold is held in long-term storage by central banks. Throughout 2024 and 2025, central banks, particularly in the East, accelerated their purchases for geopolitical hedging, effectively removing that metal from the tradable supply.

The Illusion of Price Discovery

Consequently, the price discovery mechanism for gold is broken. The majority of trading volume is executed by approximately 10 large global bullion banks and fund houses. These entities generate profit from price volatility and trading fees; they are relatively indifferent to the actual value of the underlying metal.

Due to the massive leverage available, futures and options dominate price setting. The delivery obligations in these contracts are almost never fulfilled because participants have no interest in handling heavy metal bars. Instead, contracts are "rolled over" - replaced by new ones before expiry - perpetuating a cycle of paper trading divorced from physical reality. Since paper supply exceeds physical supply by a factor of up to 100, it is clear that the supply and demand for derivatives determine the gold price, not the supply and demand for gold itself.

As of January 14, 2026, we observe a disconnect confirming this thesis. Despite record-high paper prices, there is no frenzy in the physical retail market. Conversely, medium-term holders of larger physical inventories are selling into the rally to book profits. The price is being sustained by institutional paper flows and central bank accumulation, leaving the passive paper investor exposed to a market structure that does not reflect physical realities.

C. Direct Investment in Gold Mines: The Arithmetic of Profit

Given the systemic risks of the paper gold market and the volatility of broader equities, direct investment in gold mines represents a superior medium-term alternative. It combines the upside potential of gold price developments with entrepreneurial returns, bypassing the paper casino entirely.

Investors in gold mines benefit from high gold prices, but with a significantly superior risk/reward profile compared to holding bullion. This is due to the concept of operational leverage.

Decoupling Cost from Price

The primary advantage of a gold mine is that its production costs are not pegged to the gold price. While the market price of gold may skyrocket due to monetary inflation or fear, the cost to extract an ounce of gold remains relatively stable.

Mining costs are driven primarily by energy prices (specifically diesel for heavy machinery), labour, and the cost of consumables like steel grinding balls, for example. While inflation affects these, they rarely rise in lockstep with a bullion bull market.

Modern extraction technologies have further widened this margin. The industry standard for viable mining is typically 2–3 grams of gold per ton of ore. However, state-of-the-art operations, particularly those utilizing advanced hydrometallurgy and sensor-based ore sorting techniques perfected by leading Chinese mining firms, can now profitably extract gold from ore grades as low as 1 gram per ton. This technological efficiency turns previously uneconomical deposits into highly profitable assets.

The Margin Calculation

Let us look at the current economics (as of early 2026):

Current Market Price: Approximately USD 4,600 per troy ounce.

All-In Sustaining Costs (AISC): Approximately USD 1,200 – USD 1,600 per troy ounce. (AISC is the industry standard metric representing the total cost to sustain current production levels).

Using the conservative higher end of costs ($1,600), a mine currently generates a USD 3,000 profit margin per ounce. This represents a remarkable 187.5% profit margin over costs.

The protective buffer here is immense. Even in a severe bearish scenario where gold prices plummeted to USD 3,000, a well-managed mine with these costs would still generate USD 1,400 in profit per ounce - an 87.5% margin.

Crucially, mining offers leveraged exposure to the upside. If the gold price rises by 10% - from USD 4,600 to USD 5,060 (an increase of USD 460) - that entire increase flows directly to the mine's bottom line (pre-tax). For a mine with a $3,000 margin, that $460 increase represents a 15.33% increase in profitability from a mere 10% move in the underlying commodity. This leverage is why mining investments traditionally outperform bullion mot only during sustained bull markets.

D. The New Frontier of Direct Investment in Gold Mines: Western Investment in African Gold

A defining characteristic of the current direct investment landscape is the significant flow of Western capital into African gold mining projects. This is not coincidental; it is driven by compelling geological and economic realities that make Africa arguably the most attractive mining destination for medium-sized investments.

1. Geological Endowments and "Blue Sky" Potential

While traditional jurisdictions like Canada, Australia, and Nevada are mature and heavily explored, Africa remains vastly under-explored relative to its geological potential.

Regions like the West African Craton (the Birimian Shield), spanning Ghana, Mali, Burkina Faso, and Côte d'Ivoire, as well as yet less explored countries like Tanzania, Zimbabwe, or Sambia, host world-class deposits that are often shallower and higher-grade than those remaining in Western countries. Higher-grade ore means more gold per ton of rock moved, which directly translates to lower production costs per ounce and higher profitability. For direct investors, Africa offers "blue sky" potential - the high probability of expanding reserves significantly beyond initial estimates.

2. Superior Cost Basis

Beyond higher grades, African operations frequently benefit from a lower overall cost basis. While energy costs can sometimes be higher due to infrastructure constraints, labour costs and various operational overheads are generally lower than in North America, Europe, or Australia. When combined with high-grade ore, this allows many African mines to maintain AISC in the lower quartile of the global cost curve, maximizing the operational leverage discussed earlier.

3. Improving Regulatory Frameworks

Historically, jurisdictional risk was a major deterrent for Western investors in Africa. While risks remain in specific regions, many African nations have recognized that responsible mining is a key driver of economic development. Over the last decade, numerous countries have modernized their mining codes to attract Foreign Direct Investment (FDI), offering clearer legal titles, stable fiscal regimes, and favourable repatriation policies for profits, provided that environmental and social governance (ESG) standards are met. Western investors willing to navigate these environments are finding governments eager to partner on projects that bring infrastructure and jobs.

The EMEA GOLD Eco System for Direct Investment in Gold Mines

EMEA GOLD bridges the gap between sophisticated mid-sized investors and high-potential African mining projects. We provide a secure, end-to-end ecosystem that de-risks direct investment by curating pre-vetted opportunities and structuring them through regulated EU vehicles in Cyprus. Our role extends far beyond introduction: acting as your steward on the ground, we manage technical due diligence, control capital releases based on milestones, and secure final gold offtake. By combining rigorous local monitoring with European legal protection, EMEA GOLD transforms complex mining ventures into a transparent, managed asset class, ensuring your capital is safeguarded while targeting maximum returns.

EMEA GOLD - your trusted partner for direct investment in gold mines.